$5 or $75, That Is the Question

What stories we tell, who gets to tell them, and for whom. These are the questions we’ve asked at Why Not Theatre for the past ten years. In terms of the last one—“for whom”—we constantly strive for greater accessibility for new audiences by creating works with diverse casting (non-traditional and non-professional), presenting international works from underrepresented cultures, and working in languages other than English. We also look to present work that’s financially accessible and have tried numerous ticket pricing experiments to find the best balance between access for audiences and sustainability for us.

In April 2017, we put on an adaptation of Hamlet at The Theatre Centre, Prince Hamlet, where we tried a new ticket pricing strategy that we called Pay What You Can Afford (PWYCA). Audiences had the choice of picking one of four options: $5, $25, $50, or $75. The seating was general admission no matter the price level, with no caps on the number of seats sold at each level. There were no other discounts for seniors, youth, and arts workers, and there were no promo codes. The audience could select the price they were able and willing to pay for exactly the same experience as everyone else.

From an economic perspective, the goal for any production is to have every seat sold for the entirety of the run at the highest possible price for maximum revenue. This is essentially the model for most commercial productions, when turning a profit is a necessary component of being able to put the show on at all. Because we’re in the nonprofit world, box office is an important revenue source, but it is only a fraction of the revenues that make up our budget. We are also bound by our mandates, public funding, and audiences to consider the accessibility of our ticket prices. As a result, at Why Not we have often had shows with pricing structures that looked something like $20 or $25 full price and $15 or $20 discount youth/senior/arts worker price. In terms of finding the sweet spot between access and revenues, this price range has been a safe zone for us. That said, I suspect it has caused us to lose many people for whom it’s still too expensive, and extra revenue from people who could and would pay much more.

We’ve tried other experiments in pricing. A couple of years ago, we co-produced three shows that we called the November Ticket, where you could buy an individual ticket for $30, a pass for two shows for $50, or a pass for all three shows for $60. (There were also the usual arts worker and student discounts.) The goal was to make the prices accessible for individual shows by upselling to attendance at more shows, essentially a simplified season subscription model. Interestingly, we sold relatively few two- and three- show passes—only about 5 to 10 percent of all purchases—but the overall revenues were strong due to the $30 individual ticket price. It didn’t hurt, either, that the shows were critically well received. They played to sold-out houses at the end of their runs, though all of them had empty seats in the first week or so.

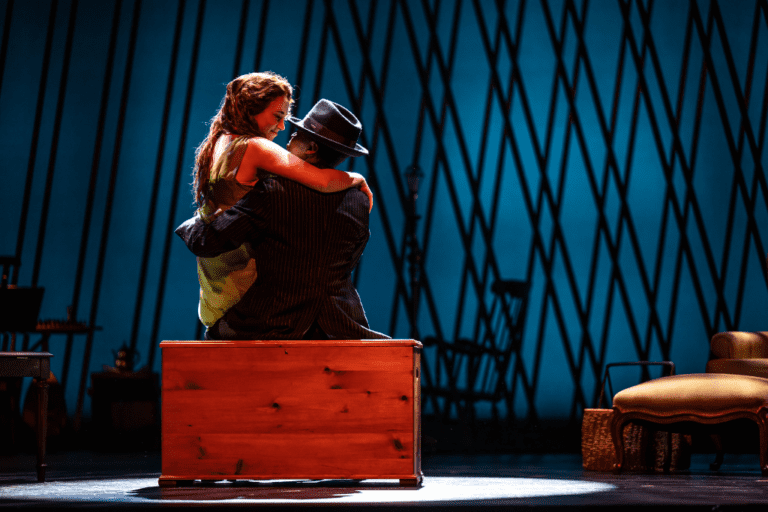

Christine Horne as Hamlet in Prince Hamlet. Photo by Bronwen Sharp.

We have also played with dynamic pricing, where the first week of the run was $20 for all tickets, followed by $25 in the second week and $30 in the last week. This strategy saw increased revenues beyond our projections, as the end of a run is always the most popular, with people scrambling to finally book tickets.

When we began talking about the pricing for Prince Hamlet, there were two major forces in opposition that we had to contend with. The first was our history of putting on high-quality work and wanting to charge a ticket price that reflected both the high production value and the excellence of the cast and creative team. Other Toronto theatres like Tarragon, Canadian Stage, and Soulpepper charge between $40 and $100 for single tickets for shows made by a similar calibre of artists. The second force was our desire to not price the show out of reach for the majority of people who cannot afford those ticket prices, ourselves included. So the dilemma was: how to appropriately value the quality of work (i.e. it’s worth $100) and simultaneously invite an audience from diverse socioeconomic backgrounds (i.e. people don’t have $100 for it). We talked through many different possible solutions, including various Pay What You Can (PWYC) structures and dynamic pricing structures, and we even considered maximizing access by having tickets funded by major sponsorships or donations and giving them all away for free.

Ultimately, we arrived at our own Pay What You Can Afford model. Sometimes PWYC means the audience can pick any amount they like, with a “suggested donation” of around $20, which in my experience becomes the bar in terms of what people think is the “right” amount. Some people may pay less than or more than that number, but I suspect few stray too far from it. “Suggested donation” numbers tend to become the average people give, with those who give less feeling guilty and only a few giving much more. A PWYC model without any suggestions may yield a wide variety of responses, but does nothing to help an audience navigate what the product may be worth or to imagine the possible range of giving options.

In our case, we pre-set four prices to choose from: $5, $25, $50, or $75. This range illustrated that the show could be worth as much as $75 (to someone who can afford it) but that paying $5 was an acceptable amount (for those who can only afford that). The $25 and $50 were picked as in-between options for those who don’t fall into those extreme categories—$25 is the amount most people are used to paying for our shows, and $50 “feels” like a larger contribution without sounding as daunting as $75.

Karen Robinson, Jeff Ho, Khadijah Roberts-Abdullah, and Rick Roberts in Prince Hamlet. Photo by Bronwen Sharp.

We debated having more options between the lower end and upper end, but the more options audiences have, the higher the level of choice paralysis. More options actually makes decision-making harder: the resulting stress reduces people’s desire to be generous and adventurous, and they are more likely to opt for the easiest way out of the tension of being undecided. In our case, this would be defaulting to the $25 price that feels safe and familiar, but doesn’t reveal our audience’s true financial capacity. We didn’t do extensive testing of many different pricing models (someone should, and please share the results!). But, based on our brainstorming, having four options at widely spaced intervals seemed like it would streamline the decision-making significantly.

In order to remove as many barriers as possible for people buying tickets, we had no fine print about who could access which price (like students or arts workers), when they could be accessed (as opposed to early bird or dynamic pricing, which privileges people who can afford to plan ahead), or the tickets’ availability (it’s common practice to reserve a small percentage of seats for discounted rush-only tickets, effectively minimizing the actual access created). We didn’t consider the $5 ticket to be “subsidized” any more than we considered the $75 to be “subsidized” (that is, both are subsidized via our public funding and fundraising efforts).

The theatre had a maximum audience potential of 1,820 for the full run, not including an invited opening night (to which everyone has received a complimentary ticket). When calculating revenue projections, we had to account for the possibility that we would maybe only sell the cheapest level of ticket ($5), which would yield a very tiny box office regardless of total attendance. On the other hand, there was the potential that the entire audience would decide to purchase the most expensive price ($75), which could bring us our highest box office revenue to date.

We expected that the likely box office result would be somewhere in the middle, with most people opting for the $25 and $5 prices but enough people choosing the higher-priced options, bumping up the average price to a number that would make the pricing structure work.

So how did we do? Before we get into the nitty gritty of the numbers, I should say that this level of public sharing of financial or statistical info is rare and comes with the same icky feeling as when telling strangers your salary. That said, our ultimate goal with the model, and with sharing this data, is to increase accessibility in the theatre, and we hope that others will follow suit.

As we expected, we sold the most amount of $5 and $25 tickets, together comprising nearly 90 percent of the sales. But the nearly 11 percent that came from the sales of the two more expensive tickets made up 30 percent of our revenue. The most expensive price point ($75) was only chosen by about 1 percent of purchasers, though I suspect the reason 10 percent of purchasers chose the $50 option was because there was a $75 option—a symptom of the “anchoring effect” phenomenon. The anchoring effect is a cognitive bias in psychology that describes our tendency to rely on the first piece of information offered during decision-making. So, for example, you want to buy a jacket for about $100, but you go to the store and you see one you like for $1200. You know you clearly can’t afford it, but wait, it’s on sale for $300. It’s still objectively three times what you think you can pay, but the $1200 “anchor” makes it feel like a much better value than it may actually be.

*The “net” numbers are what we got from the box office after deductions for facility fees, but they still include HST, which hasn’t been deducted to make the numbers easier to read. There were additional credit card processing charges that were added on top of these amounts, so those are not included.

We didn’t capture audience demographic data because of the short run, but, anecdotally, the $5 ticket was particularly popular with many first-time theatregoers, particularly members of the Deaf community (the performer who played Horatio was a Deaf actor) and those under thirty years old. Patrons were often visibly delighted upon encountering the pricing structure, which added an immeasurable but significant layer to the experience of coming to the show.

Comparing the $5 ticket to everything else ($25/$50/$75), the split was about 50/50 in terms of quantity purchased, but the three more expensive ticket options made up almost 90 percent of total revenue.

We sold about 1,434 tickets (not including comps), giving us an average ticket price of $16.35 net. The show’s total revenue was $23,443, which, over a thirteen-performance run (not including opening night), gives us an average per-show revenue of $1,803. Compared to numbers from our previous mainstage shows at the same venue, this was one of our highest performing runs on a per-show revenue basis (second only to Ballad of the Burning Star, which we co-presented with the Musical Stage Company, then known as Acting Up Stage, and had a very different audience than the one we are used to). This despite the fact that we had the lowest average ticket revenue ever—we had the highest average paid attendance per show (110 per night, and ten of the thirteen were completely sold out with waiting lists at the door).Another interesting result was that many people chose different price levels when buying more than one ticket. There were people who bought a pair of tickets with one at $50 and another at $5, some who bought two $50 tickets the first time they saw the show and $25 the next, and some who bought $25 tickets for half their group and $5 tickets for the other half, splitting the total evenly amongst the group.

Of course, we can’t generalize from this that the PWYCA strategy alone maximized attendance—it’s impossible to account for the differences in content and style from one show to the next. It may be that with a less popular production, the same ticket pricing strategy would have yielded much lower revenues than usual. On the other hand, it could also be that having the very low ticket price would increase attendance even for a less popular production, as more people would be willing to take a risk. We also can’t say definitively what percentage of those who opted for a cheaper ticket could afford a higher price, and if they would attend more productions if tickets were cheaper.

There are still many variables we’d like to test with this model. How does it do with a less popular show? Should we have a $10 option as the lowest price? What about at the upper end? $100? $500? What are the limits of the extremities? What would the long-term effect be if we consistently had this pricing for all our shows? How would this pricing structure be received at a different venue with a different audience?

We will continue to experiment with the parameters of the PWYCA strategy to see what happens. In the meantime, we’d love to hear your feedback on the strategy, the results, and ticket pricing in general. What do you think works? What doesn’t? What other strategies are out there and how do their numbers look? Surely, we can better address Hamlet’s complaint that our current pricing structures are “weary, stale, flat, and unprofitable.”

Comments